Leave travel allowance is a benefit that many companies give to their employees. It helps you cover the travel costs when you go on a trip with your family. Leave travel allowance is not just a fun bonus; it’s also a smart way to save money on taxes while exploring new places. Many people don’t know how this allowance really works or what rules they need to follow. In this blog, we’ll explain everything in easy words so you can use your leave travel allowance the right way and enjoy your holidays without confusion.

Leave travel allowance is also known as LTA, and it’s part of your salary package. You can use it to claim the cost of travel within India for yourself and your family members. But there are some conditions, like the mode of travel, number of times you can claim, and the family members who are included. Knowing these details helps you plan better trips and get full benefits from your leave travel allowance. Let’s learn step-by-step how it works and how you can make the most of it.

Understanding Leave Travel Allowance: A Simple Guide to Save Money While Traveling

Leave travel allowance is a special benefit that helps employees save money while traveling with their families. Many companies give leave travel allowance (also called LTA) to their workers as part of their salary package. It helps cover travel costs during holidays or family trips within India. This allowance is not just a reward for hard work; it also helps you save on taxes. However, many people don’t fully understand how leave travel allowance works, what rules to follow, or how to claim it properly. In this article, we’ll explain everything in simple and easy English so you can enjoy your travel without any confusion.

Leave travel allowance can make your vacation more affordable if used the right way. It allows you to claim travel expenses for yourself and your family when you go on leave. But it’s important to know what kind of travel is covered and what is not. For example, travel by air, train, or public bus is allowed, but local taxi or hotel bills are not included. Understanding these small rules helps you plan better and make full use of your leave travel allowance benefits. Now, let’s go step by step to learn everything about it.

What Is Leave Travel Allowance and Why It Matters

Leave travel allowance is the part of your salary that helps you pay for travel when you take time off work. It is a benefit given by employers to encourage employees to take vacations and spend time with family. The best part is that this allowance can also reduce your taxable income if you follow the rules given by the Income Tax Department of India.

It matters because it helps you travel more often without worrying too much about the cost. You can plan a family trip, relax, and return to work feeling fresh. Many people ignore this benefit, but when used wisely, it can help save a lot of money each year.

How Does Leave Travel Allowance Work in Simple Words

Leave travel allowance works like this: your employer adds a travel benefit to your salary package. When you go on a vacation within India, you can claim the travel cost for yourself and your family. But you must provide proof of travel, like tickets or boarding passes.

For example, if you travel by train or flight, you can claim the ticket cost. However, expenses like food, hotel, or sightseeing are not covered. The tax exemption applies only to the cost of travel. You can claim this exemption for two journeys in a block of four years as per government rules.

Rules and Conditions for Claiming Leave Travel Allowance

Here are some simple rules you must follow to claim leave travel allowance:

- You can claim only domestic travel (within India).

- The claim is allowed for yourself, your spouse, children, and dependent parents or siblings.

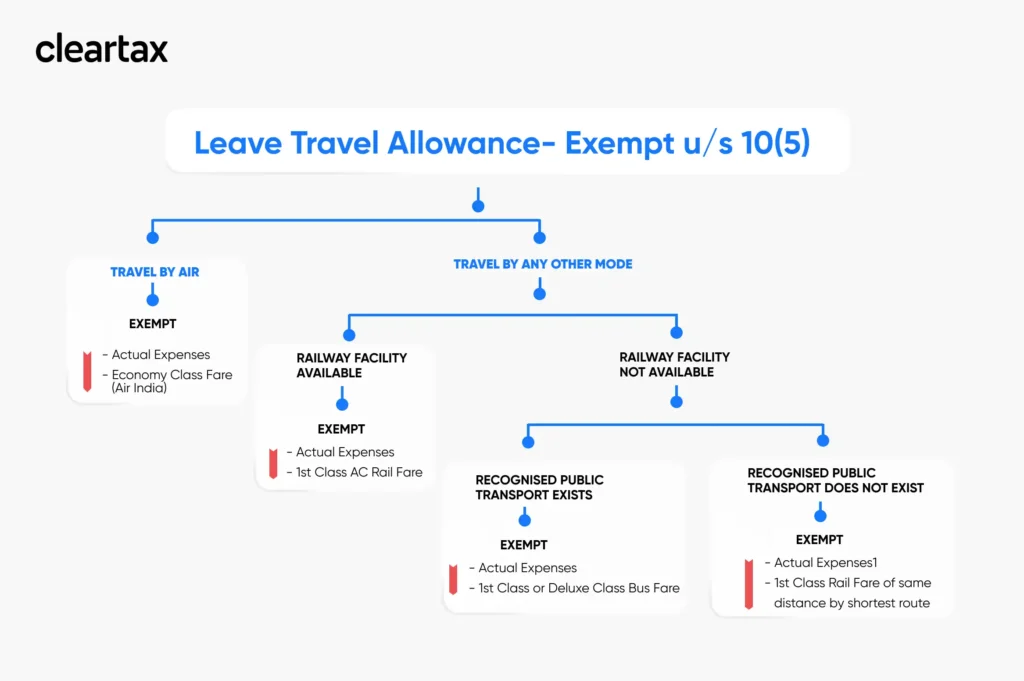

- You must travel by approved modes such as air, train, or public transport.

- You need to submit proof of travel, like tickets, to your employer.

- You can claim leave travel allowance twice in a block of four years.

If you don’t use your claim in one block, you can carry it over to the next block. So, it’s flexible and helps you plan your trips better.

Who Can Get Leave Travel Allowance Benefits

Leave travel allowance benefits are available to salaried employees who receive this allowance as part of their pay package. Self-employed people usually don’t get LTA unless they have a business structure that allows it.

Your family members who can be included in the LTA claim are:

- Your spouse

- Your children (up to two)

- Your dependent parents and siblings

If you travel alone, you can still claim the benefit for yourself. But if your company has special rules, always check with your HR department before making travel plans.

What Travel Expenses Are Covered Under Leave Travel Allowance

Leave travel allowance covers only the travel fare, not other holiday costs. This includes:

- Airfare (economy class) if you travel by air

- Train fare (first-class AC) if you travel by train

- Bus fare (deluxe or government bus) if no train or flight is available

Expenses like hotel stays, food, taxi rides, or sightseeing are not covered. Many people make the mistake of including these in their claim, but they are not accepted under the LTA rules.

Simple Example to Understand Leave Travel Allowance Claim

Let’s say you work in a company that gives you a leave travel allowance of ₹40,000 per year. You take a trip from Delhi to Goa with your spouse and two children. You travel by air, and the total airfare costs ₹35,000.

You can claim ₹35,000 as leave travel allowance because it covers your travel cost within India. However, if you spent ₹10,000 more on hotels or food, you cannot include that in your claim. Your employer will accept only the ticket amount as per the rules.

Common Mistakes People Make with Leave Travel Allowance

Many people lose their leave travel allowance benefits because of small mistakes. Some common ones include:

- Claiming expenses for foreign trips (not allowed)

- Forgetting to keep travel tickets or proofs

- Including hotel and food bills in the claim

- Not understanding who qualifies as a family member

To avoid these problems, always read your company’s policy and keep all travel receipts safe.

How to Save Tax Using Leave Travel Allowance Smartly

Leave travel allowance can help you save tax if you claim it correctly. The exemption you get depends on your travel route and the mode of transport. For example, if you take a train journey, you can claim the first-class AC fare, even if you travel by car.

Plan your holidays smartly during the LTA block period and make sure you claim twice within four years. This way, you’ll enjoy vacations and save money at the same time.

Documents You Need to Claim Leave Travel Allowance

To claim leave travel allowance, you should have:

- Original tickets or boarding passes

- Travel receipts with names and dates

- Proof of relationship (if claiming for family members)

- Leave approval or travel permission from your company

Submitting these documents on time helps your employer process the claim easily.

Conclusion

Leave travel allowance is a great way to save money while enjoying vacations with your loved ones. It’s simple, helpful, and easy to use if you know the rules. By understanding what’s covered and what’s not, you can plan your trips wisely and get tax benefits at the same time. Always remember to keep your travel proofs and claim within the right block period. So next time you plan a trip, make sure to use your leave travel allowance and make the most of your holiday budget.

FAQs

1. What is leave travel allowance?

Leave travel allowance is a benefit given by employers to help employees cover travel costs for trips within India.

2. Can I use leave travel allowance for foreign trips?

No, leave travel allowance is valid only for travel within India.

3. Can I claim hotel and food expenses under leave travel allowance?

No, only travel fares like air, train, or bus tickets are covered.